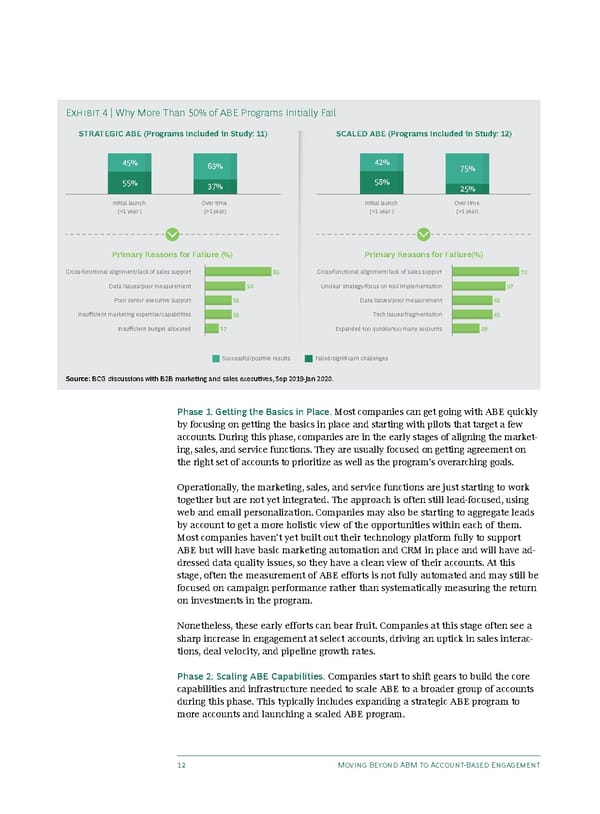

Exhibit 4 | Why More Than 50% of ABE Programs Initially Fail STRATEGIC ABE (Programs Included in Study: 11) SCALED ABE (Programs Included in Study: 12) 45% 63% 42% 75% 55% 37% 58% 25% Initial launch Over time Initial lau nch Over time (<1 year ) (>1 year) (<1 year ) (>1 year) Primary Reasons for Failure (%) Primary Reasons for Failure(%) Cross-functional alignment/lack of sales support 83 Cross-functional alignment/lack of sales support 72 Data issues/poor measurement 50 Unclear strategy/focus on tool implementation 57 Poor senior executive support 33 Data issues/poor measurement 43 Insufficient marketing expertise/capabilities 33 Tech issues/fragmentation 43 Insufficient budget allocated 17 Expanded too quickly/too many accounts 29 Successful/positive results Failed/significant challenges Source: BCG discussions with B2B marketing and sales executives, Sep 2019-Jan 2020. Phase 1: Getting the Basics in Place. Most companies can get going with ABE quickly by focusing on getting the basics in place and starting with pilots that target a few accounts. During this phase, companies are in the early stages of aligning the market- ing, sales, and service functions. They are usually focused on getting agreement on the right set of accounts to prioritize as well as the program’s overarching goals. Operationally, the marketing, sales, and service functions are just starting to work together but are not yet integrated. The approach is often still lead-focused, using web and email personalization. Companies may also be starting to aggregate leads by account to get a more holistic view of the opportunities within each of them. Most companies haven’t yet built out their technology platform fully to support ABE but will have basic marketing automation and CRM in place and will have ad- dressed data quality issues, so they have a clean view of their accounts. At this stage, often the measurement of ABE efforts is not fully automated and may still be focused on campaign performance rather than systematically measuring the return on investments in the program. Nonetheless, these early efforts can bear fruit. Companies at this stage often see a sharp increase in engagement at select accounts, driving an uptick in sales interac- tions, deal velocity, and pipeline growth rates. Phase 2: Scaling ABE Capabilities. Companies start to shift gears to build the core capabilities and infrastructure needed to scale ABE to a broader group of accounts during this phase. This typically includes expanding a strategic ABE program to more accounts and launching a scaled ABE program. 12 Moving Beyond ABM to Account-Based Engagement

BCG moving beyond ABM to account based engagement Page 13 Page 15

BCG moving beyond ABM to account based engagement Page 13 Page 15