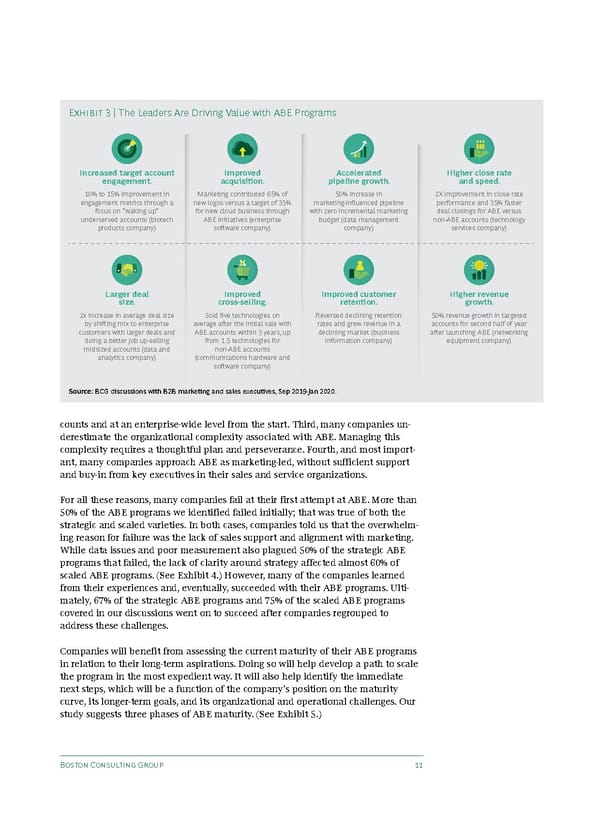

Exhibit 3 | The Leaders Are Driving Value with ABE Programs Increased target account Improved Accelerated Higher close rate engagement. acquisition. pipeline growth. and speed. 10% to 15% improvement in Marketing contributed 65% of 50% increase in 2X improvement in close rate engagement metrics through a new logos versus a target of 35% marketing-influenced pipeline performance and 35% faster focus on “waking up” for new cloud business through with zero incremental marketing deal closings for ABE versus underserved accounts (biotech ABE initiatives (enterprise budget (data management non-ABE accounts (technology products company) software company) company) services company) Larger deal Improved Improved customer Higher revenue size. cross-selling. retention. growth. 2x increase in average deal size Sold five technologies on Reversed declining retention 50% revenue growth in targeted by shifting mix to enterprise average after the initial sale with rates and grew revenue in a accounts for second half of year customers with larger deals and ABE accounts within 3 years, up declining market (business after launching ABE (networking doing a better job up-selling from 1.5 technologies for information company) equipment company) midsized accounts (data and non-ABE accounts analytics company) (communications hardware and software company) Source: BCG discussions with B2B marketing and sales executives, Sep 2019-Jan 2020. counts and at an enterprise-wide level from the start. Third, many companies un- derestimate the organizational complexity associated with ABE. Managing this complexity requires a thoughtful plan and perseverance. Fourth, and most import- ant, many companies approach ABE as marketing-led, without sufficient support and buy-in from key executives in their sales and service organizations. For all these reasons, many companies fail at their first attempt at ABE. More than 50% of the ABE programs we identified failed initially; that was true of both the strategic and scaled varieties. In both cases, companies told us that the overwhelm- ing reason for failure was the lack of sales support and alignment with marketing. While data issues and poor measurement also plagued 50% of the strategic ABE programs that failed, the lack of clarity around strategy affected almost 60% of scaled ABE programs. (See Exhibit 4.) However, many of the companies learned from their experiences and, eventually, succeeded with their ABE programs. Ulti- mately, 67% of the strategic ABE programs and 75% of the scaled ABE programs covered in our discussions went on to succeed after companies regrouped to address these challenges. Companies will benefit from assessing the current maturity of their ABE programs in relation to their long-term aspirations. Doing so will help develop a path to scale the program in the most expedient way. It will also help identify the immediate next steps, which will be a function of the company’s position on the maturity curve, its longer-term goals, and its organizational and operational challenges. Our study suggests three phases of ABE maturity. (See Exhibit 5.) Boston Consulting Group 11

BCG moving beyond ABM to account based engagement Page 12 Page 14

BCG moving beyond ABM to account based engagement Page 12 Page 14